Return on Investment (ROI) – Part 1 of 6 Things to Consider When Planning a New Dock

Most floating structure construction projects constitute a significant financial investment into your marina’s future. Analyzing the return on your financial investment is probably the most important step on your dock-building journey. It is the first step you should take to evaluate whether your new boat dock is an investment worthy of pursuit.

Simply put, ROI is a ratio that measures the profitability of an investment by weighing the cost of an investment against the profit that investment will generate. For ease of understanding, ROI is almost always expressed as a percentage. [1]

How to calculate ROI:

Believe it or not, calculating ROI is not as complex as it may seem. Several formulas are frequently used to calculate ROI, but we will use one of the most straightforward. Also, we can only calculate Anticipated ROI as the actual ROI isn’t determined until the actual costs are incurred. Oddly, there are multiple formulas for calculating ROI [2].

Hmm… that’s a lovely formula; how do I use it?

Here’s a simplified example that will help you grasp the concept in a practical way:

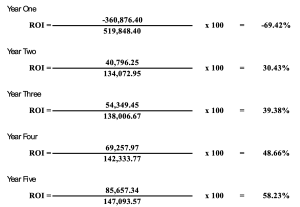

We are building a new 22-slip boat dock. We will pay 50 percent of the dock’s cost in the first year and fund the rest with debt financing amortized over five years. For this example, we will run a separate ROI for each of the dock’s first five years in service. Our scenario assumes a one percent increase in income and expenditure each year. Our investment cost will need broken down for each year.

For this example:

Operating Costs for Year One include 50% of the dock’s building cost, loan payments, taxes, insurance, labor, and expenses associated with operating the docks.

Operating Costs for Years 2 through 5 include loan payments, taxes, insurance, labor, and other expenses associated with operating the docks.

Income for years 1 through 5 includes rent, utility payments, and advertising space.

Operating Costs are subtracted from Income to determine Net Profit.

Now, we will divide our Net Profit by the cost of investment.

You’ll note that we have a negative return in year one. This is the effect of the 50% down payment. Additionally, you will note that profits increase year over year. This is partially the result of our amortized loan. While income is rising, your principal and interest payments remain the same year after year.

While ROI is most commonly calculated on an annual basis, you may calculate it over any time period. The entire lifespan of the dock, ten years of service, or some other scenario that you, your lender, and/or your financial advisor are comfortable with.

Net Profit:

Net profit is gross profit, sometimes called gross income minus operating expenses and taxes.

When considering profit or income, determine rental income, utility fees, advertising space, etc. You may experience income from peripheral sources such as increased fuel or merchandise sales or more patrons at your restaurant. However, you should only consider the income directly attributable to the dock. When considering a dock that provides no direct income, such as a restroom or party dock, consider rolling its cost with the project that will benefit most. For example, roll the cost of a restroom dock in with your fuel dock or a party dock in with the cost of your boat storage dock when determining ROI.

Cost of Investment:

In addition to the cost of the dock (Cost of Investment), your operating expenses and taxes contribute to your investment cost. Include employee wages, insurance, maintenance, and other expenses associated with the dock’s running or upkeep. Ryan Hamilton, Port of Kimberling Resort and Marina (retired), advises being especially mindful of rising insurance premiums. Lisa Duncan, Lake Mead Adventures, warns that it’s easy to think that adding a new dock won’t affect your labor expenses, but be realistic: additional members, maintenance, and cleaning add up to real payroll increases.

Other Considerations:

Unmeasurable/Intangible – It is often difficult to determine the intangible benefits of your dock construction project, especially for structures that do not generate rental revenue. Would anyone patronize your ice cream shop if the fuel dock weren’t part of your marina? Do people buy fuel at your marina because they can get ice cream? Will building a nice restroom dock increase foot traffic in your ship store; will more boaters eat at your restaurant? Do members rent your slips because your brand is associated with top-notch hospitality? Intangible assets are difficult, if not impossible, to quantify but must be considered for their ability to enhance core revenue streams.

Use of borrowed funds. Leveraging your funds to borrow from a bank or private lender can be a good way to improve your return on investments on a year-to-year basis, but it may provide for a lower return when calculating ROI over the life of your dock. While your investment will cost more in the long run than paying for the project outright, leveraging your working capital towards a more significant investment (bigger dock) may lead to greater profits with a less significant impact on your annual cash outlay. Other financial analysis methods, such as Cash Flow Analysis, should also be considered when using borrowed funds.

In Conclusion:

While ROI is an important measure of an investment’s performance, there is more to consider. A marina owner should use ROI alongside other financial analyses before adding a new dock.

Here are a few other methods to help evaluate the feasibility of your new dock project:

- Cash Flow [3] [4]

- Net Present Value [5] [6]

- Payback Period [7]

- Rate of Return [8]

This article is not meant to provide financial advice, is for informational purposes only, and cannot be relied upon. The scenarios depicted in the example are fictitious and do not represent typical rates of return. Do not make financial decisions without consulting a tax, investment, and/or accounting professional.

- Beattie, A. (2024) ROI: Return on Investment meaning and calculation Formulas.

- How to calculate ROI to justify a project | HBS Online (2020)

- How to read & understand a cash flow Statement | HBS Online (2020).

- FreshBooks (2024) What is Cash Flow Formula and How to Calculate It?

- Gallo, A. (2017) A refresher on net present value.

- Fernando, J. (2024) Net Present Value (NPV): what it means and steps to calculate it.

- Kagan, J. (2024) Payback Period: Definition, Formula, and calculation.

- Kenton, W. (2024) Rate of Return (ROR): Meaning, formula, and examples.

No matter what form your capital expansion project takes, partnering with MariCorp US will ensure it’s on time and on budget. Speak to an expert now, call 877-858-DOCK.

Related Articles:

- Revenue Generator: Boat Winterizing Services

- Generate Revenues with Service Center

- Six Things to Consider When Planning a New Dock (Abridged)

- Planning and Timing – Part 2 of 6 Things to Consider When Planning a New Dock

- Permitting Requirements – Part 3 of 6 Things to Consider When Planning a New Dock

- Insurance – Part 4 of 6 Things to Consider When Planning a New Dock (Coming in January)*

*Sign up for our free newsletter “Marina Management Journal” so you can stay up to date

About MariCorp

Maricorp is one of the largest floating boat dock manufacturing and construction companies in the United States, specializing in galvanized steel floating docks and boat lift systems. With projects spanning coast-to-coast, Maricorp provides marina consultation and design, marine construction, marina repair and renovation, and boat dock disaster response and demolition.